Sam and I have been thinking about ways we can ensure a happy and hopefully prosperous future for our children. Although our income isn’t as high as it was when I was working full time in hospitality management we still know how important it is to keep some money aside for the future of Athena and Arlo, to ensure that we are able to help support them through university, or any other training that they want to pursue! We’re already living a fairly frugal lifestyle, searching around for the lowest price available when we buy things, driving an older car that we don’t plan to replace until we really have to and generally watching what we spend.

There are a lot of different ways to save for your children’s future, one easy way to save is a Junior ISA which is flexible option and great because it is exempt from capital gains tax and income tax. All growth within the plan and money withdrawn from the plan is tax-free!

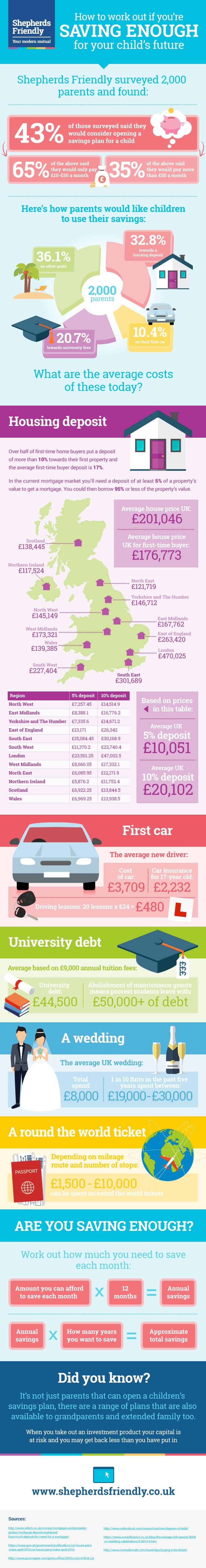

Sheperds Friendly have put together statistics, some of them are a little alarming, a 44k debt from uni, and an average of 20k needed for a deposit for a house…

So, are you saving enough for your child? This is definitely food for thought!

This is a collaborative post, all words and opinions are my own.